You can't exorcise a demon without first looking it in the eye.

It is a scary truth that we must look our demons in the eye before we can exorcise them. This is true about lots of kinds of demons. Although I knew I was spending more than I should on meaningless things, I didn't really know for sure where my money was going. I couldn’t solve a problem that I didn’t understand, but for quite a while I was more comfortable remaining ignorant. (Because knowing exactly how much money I was wasting could flood me with deep shame. Because the situation could be even worse than I thought. Because I would have to share my new understanding with my husband. Because once I confronted the issue, I would have to act on it.) Eventually, the queasy feeling that came with every dollar I spent (even the necessary ones) and the increasing worry about how my current habits were unintentionally affecting my future caught up to me, and I delved into where my dollars were going.

Below, I give a blow-by-blow account of how I combed through every expense I had in recent months and what I learned along the way, but there are tools for tracking all the things we "spend" these days. Maybe you are amazing with your money, but your smart phone sucks up your time. There are apps that track all that screen time go and limit social media use. Maybe you don't make time for exercise or you haven't been as mindful about food as you'd like. Maybe you come to the end of each day wondering how you didn’t manage to squeeze in even one activity that you really loved: If so, make a promise to track how you spend your time for a week. Once you’ve taken time to measure, you can use your new insight to change your habits.

I have used all these kinds of tools from time to time, but spending my money more mindfully was what I needed to figure out now. I adapted my method from one outlined by Anna Newell Jones in her book The Spender's Guide to Debt-Free Living.

STEP 1: Show me the money (in black and white)

GATHER YOUR DATA.

You’re gonna need cold hard facts to start as your basis. I pulled three months of bank statements for all of my accounts that involved non-essential spending... including my credit card. If you are charging anything, you’ll want to pull information on all of your credit cards too. It might sound brutal or terrifying, but true financial honesty is the strongest weapon you have against bad spending habits.

With a few clicks, I had three months of information (you can use less if you feel incredibly confident that the last month or so is a good example of how you spend, but more months will be more accurate if you’ve had additional expenses or have already started cutting back). My bank gave me the option of putting the list of all my transactions into an Excel spreadsheet. This made step two much easier, and I highly recommend this if your bank offers it.

STEP 2: I’ll take “Dining Out” for $500, Alex

CATEGORIZE IT.

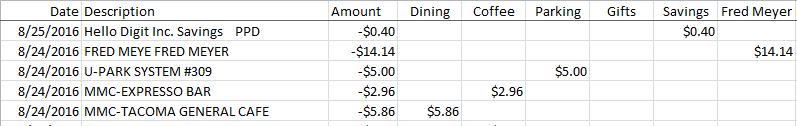

A tediously long list of transactions doesn't help us uncover the bad habits on its own. In order to see what's really happening, every expense needs to be looked in the eye and categorized. To get started, I added some spending categories across the top of the excel spreadsheet that I downloaded from my bank's website. Then, I began assigning each expense where it fit best. (No Excel? No problem. You can do this on paper too.) Every person's categories, like their spending habits, will vary. I started out by naming some categories I knew I would need to track and added some unexpected extras as I went along. (Again, don't forget to include those credit card statements.) Here is a sample from my "spending" account (my husband and I have a shared bills account and our own spending money accounts):

Tedious work that pays off: You have to know your bad habits before you can change them.

STEP 3: What seems to be the problem, officer?

LOOK FOR PATTERNS.

When I totaled up my various categories, the bad habits were there in black and white. This is when I learned I was spending an average of $131 per month on expensive coffee drinks. While I'd expected that coffee, fast food, and parking were problem areas for me, other spending categories were a surprise. We didn't eat out often (and often my husband picked up the bill), but restaurant dining was eating up a much bigger chunk of my spending money than I would have predicted. More surprises: I'd dropped roughly $20 on PokemonGO and was spending over $60 per month on gifts. There was also some good news: The automatic savings app that I'd started using a year earlier had been socking away about $35 per month without me taking much notice. Altogether, this information revealed some pretty distinct patterns.

Almost all of my problem spending was related to being tired, hungry, or behind schedule. Basically, my budget was being burned up by a lack of prior planning. When I paid for parking because I hadn't left home in time to walk the half mile from a free spot. When we went out to dinner because we were exhausted and didn't have an easy meal ready. When I picked up fast food or ate out for lunch because I didn't plan ahead. When I bought coffee because I was dragging tired and wanted to keep giving 110%. This realization changed the way I thought about how I was spending money.

STEP 4: Now What?

BE SOLUTION-ORIENTED.

Be kind to yourself. Do not beat yourself up over past choices. Look at the truth before you, and let that truth help you change the future.

Looking at my spending in detail did not drown me in shame the way I'd feared. Instead, it gave me real tools I could use to fix the habits I didn't like. My bad spending habits were less about how I was managing money and more about me failing to take good care of myself. Knowing this, I could quit berating myself about my spending and start putting that energy into being rested, well-fed, and on-schedule. This new awareness also gave me a tool to use before swiping my debit card: questioning myself about the reasons behind my purchases.

I began asking myself about other ways I might be using money to cover for unhealthy habits: Was I participating in fundraisers I wasn't passionate about because I was worried about injuring relationships? Did I feel compelled to buy new clothes for some events because I was self-conscious about my looks or a bit too worried about what others would think of me? Could I spend less on gifts if I found other ways to convey the depth of my friendship? Questions like these will continue to be a part of my journey to make sure my money is mindfully spent.

Pin It! And never Forget it!

Don't Wait.

As almost every manager everywhere has ever said: “You can’t manage what you can’t measure (Peter Drucker)." I didn't have to spend a year wallowing in worry about my spending habits. There was a cure for the guilt I felt whenever I would approach a cashier with a purchase. Once I was honest with myself, I was surprised to find some easy wins that motivated me to stay on track.

Keep in Touch.

Our subscribers get periodic email updates on what's new, and we share every post as it happens on our social media accounts.