Our cars are paid in full! What could be better?

Yes! Both of our vehicles are officially paid off! Debt-free cars! We'll get back to celebrating that in just a second...

Each month, transportation and groceries costs have traditionally duked it out for the number two expense in our budget. Our experience is not an unusual one. Vehicles are the second-biggest expense in many American households, right after housing. While we spend a lot of time accounting for the small stuff in our budget (negotiating for a cheaper cable rate or saving a few bucks on Ibotta), the big bills give us an opportunity for notable savings over time.

Shortly after I made a goal to reduce my personal spending and our household debt, I wrote about discovering an unexpected and expensive problem with my car. Because I had just begun to reconsider the way I spent every penny, I was uncertain whether to repair or replace the car. Luckily, the repair could be postponed, and that's the temporary choice we settled on while we began improving our financial health.

As suburb-dwellers without sufficient public transportation, we're one of those shameful two-car households depleting more than our share of ozone. We can't (won't?) give up our cars just yet, but this doesn't mean we have to lie down and be beaten by monstrous automobile-related bills. A little innovation, frugality, and some hard work have helped us reduce our overall monthly vehicle costs while we delayed the decision on my car. And, we have big plans to save even more. Below you'll find an overview of all the ways we're keeping our commute costs low, and how we're planning to do even better as moving forward.

Beginner's Luck

When we committed to paying off our consumer debt last year, we took a hard look at how we were spending money. We were happy to find that we were already making some comparatively conservative choices about most transportation costs.

Specifically, there were three ways that we were already saving:

1. Smart Scheduling.

My workplace participates in "Commute Trip Reduction" and offers alternatives that allow us to save on our commute. In addition to transit passes and carpooling options, my employer also offer flexible schedules, including compressed work weeks. In exchange for working a bit longer each day, I am able to take one day off every two weeks. In addition to compensating for the more generous vacation package I gave up when I came to my current employer, a compressed work week cuts my commuting time and costs by 10%. You'll see below that the savings adds up.

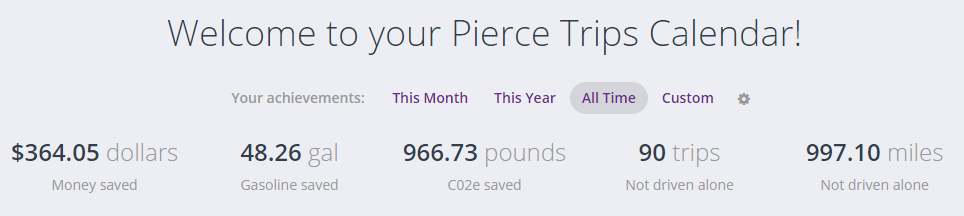

In addition to spending less hours on the road, an average commuter would have saved an estimated $364 after about 20 months on my compressed schedule (based on a roughly 11-mile commute):

2. Finicky about Fuel Consumption.

My husband and I were each born seeking reliability and good gas mileage when we look for a new car (although I've heard he did have a stylish, vintage Volvo before we met). Luckily, that's how we've stayed. My husband drives a vehicle with that averages 35 miles per gallon, while my hatchback gets just under 30 miles per gallon (and is a surprisingly good substitute for a truck when we need to bring home lumber or transport larger items).

In addition to our commutes, we love weekend road trips. Gas-saving vehicles mean less expensive weekend getaways when we travel with friends to the San Juan Islands or visit family on the opposite side of the state.

3. Driver's Debt.

Even when we were being comparatively irresponsible with our money, we didn't rack up debt on fancy cars. You've likely already put together that my husband and I have Plain Jane taste in vehicles. When we buy a car, we drive it for a decade if we can.

In 2015, we used wedding gift money for a significant down payment on a newer car. We got about $500 in return for our run down, ten-year-old trade-in. We also saved money by buying a slightly used car with manual locks and manual windows from a dealer in a more rural part of our state. Still, we owed more than $7,000. Luckily, thanks to our naturally frugal impulses, that was the only car payment we had.

We did not pay aggressively on our car loan because of it's ridiculously low interest rate (0.9%). But this month, we used our tax return to obliterate the remaining balance, making us a car payment free household!

But it could be better...

So... we've got two paid-in-full cars with great gas mileage. What could be better? After taking a moment to celebrate what we've achieved, we have to admit that we absolutely could be saving even more. We aren't ready to be a one-car household, but there are two things we aim improve: 1.) Staying car payment free; and 2.) Not overpaying for car insurance.

Car Payments: NEVER AGAIN.

We are still working hard to pay off our credit card debt, but we have also been identifying ways that we can use our money to buy peace of mind. I've talked before about the home repair fund that's been helping me sleep better these days. The aging state of one of our vehicles has been another source of stress. It has forced us to consider how we'll pay for repairs and replacement vehicles down the road.

We've got two strategies to help us avoid a car payment in the future :

- Fix 'er up!

We will not be replacing my ten-year-old car. Nope. She has just over 153,000 miles on her, but we've decided to make the $2k repair (Thank goodness for our tax return!) and hope that she's able to make it to 200,000 miles. Based on online reviews, it's not an impossible hope. My ego seems to be adjusting to the idea okay too.

- Save it up!

We don't plan to drive the same cars forever. At some point, the only thing that will save us from a future car payment is cold hard cash. That's why we'll be opening our second sinking fund this spring and begin saving right away for our future replacement car.

But where will the money come from? We are using all the regular monthly income we can scrape up to pay off our consumer debt (and we're making some amazing progress!), but we found a magical revenue source to help us prepare for car replacement: mileage checks.

My husband drives frequently in the course of his work as a social worker. He's reimbursed through a monthly mileage check. After taking enough money off the top to cover his out-of-pocket expenses for gas and oil changes, it provides us with a small amount of extra income. In the past, we've used these checks to help cover the cost of road trips and other unusual expenses. We've decided it's time to get more disciplined and set them aside in a savings account for car repairs and replacement.

The High Cost of Car Insurance

The cost of car insurance runs us about $165 per month (for full-coverage on two cars). When we began our work to improve our finances, I was hopeful that we could find a cheaper rate and save a bundle each month. No so much. In fact, when our son gets his license, we'll be seeing an $80/month increase.

We have pretty extensive car insurance right now. We made that choice because we have limited money set aside to help us cover the costs of an emergency. However, in just 6-9 months, we'll be completely free of consumer debt and rapidly building a much more robust emergency fund. As our emergency stash builds, it will be time to make changes that will save us money on car insurance: we'll raise our deductibles and look at decreasing or removing the comprehensive coverage on our aging cars.

The ability to make changes in our car insurance is much more exciting than it sounds. Here's what it truly means:

“ The work that we’ve been doing to pay off debt & build an emergency fund is going to help us save even more money each month! ”

When we started this journey roughly six months ago, I thought we would need to pay down debt, completely stock up our emergency fund, and then start investing before our hard work started paying us back. I'm happy to declare that I was completely wrong. Our work to improve our finances is paying us back in even more ways than just car insurance savings... but that will be a story to share another time.

Keep in Touch.

Mindfully Spent subscribers get periodic email updates on what's new, and we share every post as it happens on our social media accounts.